A drone is a small unmanned aircraft system that unlike on board piloted aerial devices, is flown by a human with feet firmly planted on the ground. They are usually flown via remote control. Some of the newer models can be programmed to fly specific GPS coordinates. Drone usage can be divided into two basic categories: recreational or commercial use. Before you fly one, it’s important to do research on drone insurance to review the options for drone coverage in case the drone crashes, as well as liability insurance if you happen to damage someone’s property or hurt someone.

Recreational Drone Insurance

If you are flying your drone for recreation, your drone insurance coverage needs largely depend on how seriously you take your hobby, as well as how much time and money you are planning on investing into your drone. If you are flying a top of the line model that costs upwards of $2,000, it makes sense to get some sort of liability coverage so that you and your drone are protected.

Not only will drone insurance give you peace of mind, it will also make repairing or replacing your drone in the event of an accident a much easier experience.

Securing drone insurance for recreational use is very simple.

Commercial Drone Insurance

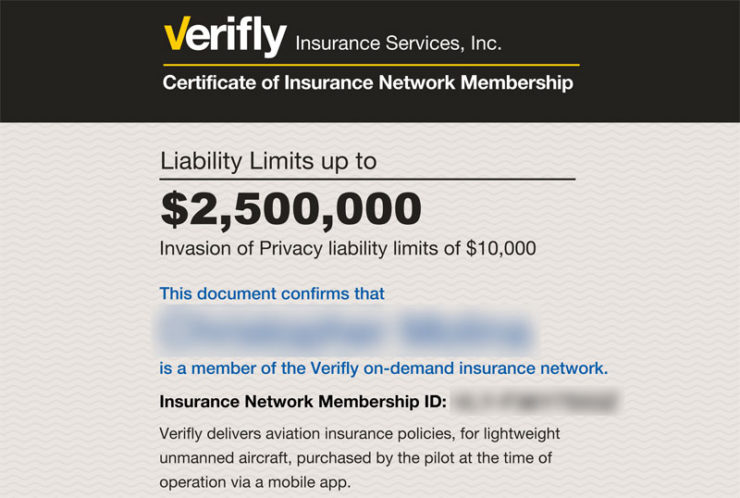

Here is a common Drone Insurance Policy from the company Verifly

There is no law in the United States that requires commercial drone insurance. This does not mean that insuring your commercial drones should not be a priority. Most potential clients prefer to work with an insured contractor. In fact, some will not work with uninsured drone operators. Whether you provide inspection services, aerial photography or anything in between, your client will most likely require proof of insurance before hiring you for a project.

Reasons to Insure Your Drone

Whether you’re flying purpose is business or leisure, it makes sense to get, at minimum, a liability policy for your drone in case something goes wrong.

Here are 5 good reasons you should consider drone insurance:

- Situations out of your control: Just like any other mechanical device, drones can experience mechanical or software failure while airborne. Birds have also reportedly collided with drones, causing injuries and thousands of dollars in loss. An event outside of your control, such as a mid-air collision or system malfunction can be devastating, and create a great deal of damage, no matter how small your drone is.

- Privacy concerns: Drones can be a great surveillance tool, but not everyone in your neighborhood will think the same. People tend to be extremely cautious if they feel their privacy is being violated. For example, your drone inadvertently flies past a window, and captures images of people in embarrassing or compromising situations. If this happens, you can be sued for violating that person’s reasonable expectation of privacy. However, drone insurance policies are designed to protect the drone owner/operator from damages, as well as cover legal fees incurred by a lawsuit.

- Your homeowner’s policy might not cover your drone fully : Most homeowner’s and renter’s insurance policies do not include drones or recreational flying toys in their coverage. Do not assume you are covered; always check with your insurance agent to be sure. Even if your insurance does cover drones, chances are that it is limited and might leave you exposed to potential damages and loses.

- You may crash into power lines: Before mastering piloting, crashing into power lines is one of the most common accidents new drone owners experience. This commonly happens when drone pilots allow the drone to slip beyond their field of view. A drone entangled in power lines will not only damage your drone, it can also cause great losses to surrounding homes and the power company.

- You may unknowingly violate FAA UAS (unmanned aircraft systems) rules : The FAA has placed regulations on the use of drones in U.S. airspace. There are limitations on how far and how high you can fly. Failure to follow rules and regulations can result in penalty and fines, as well as violations of safety, leading to accidents. You’ll not only want to familiarize yourself with these rules, but also to protect yourself with insurance for your drone,

How Much Does Drone Insurance Cost?

Three years ago, it would have cost you about $1,500 per year to insure a drone. On average, commercial drone insurance will cost anything from $600 to $800 per year currently. There are even insurance companies that you can pay per drone job such as Verifly. For as little as $10 per flight, you can be insured for $1 million dollars. A small price worth paying when considering that damages can be many times that cost.

The Bottom Line When It Comes To Drone Insurance

When examining the potential risks related to operating a drone, be it commercial or recreational, you need the right kind of insurance to keep safe and avoid damages and losses. The unexpected always happens when no one expects it. Having drone insurance can keep you protected and offer peace of mind.